Every October, the world turns to horror. Porch lights glow behind carved pumpkins, ghost tours pop up in towns and cities, and a familiar shift shows up in MUSO’s data. Horror moves from its usual place as the eighth most popular film genre to sixth, as global audiences seek out scares in greater numbers.

This isn’t a one-off spike. It’s a seasonal habit, baked into viewing behaviour year after year.

Halloween Night: A Reliable Surge

Looking at 31 October alone, the picture becomes sharper. Each Halloween brings a clear, measurable jump in demand. The top titles on that single night from the horror genre tell their own story:

31 October 2020: Roald Dahl’s The Witches

31 October 2021: Halloween Kills

31 October 2022: Barbarian

31 October 2023: Five Nights at Freddy’s

31 October 2024: Terrifier 3

The growth curve is hard to ignore. In 2023, these titles generated millions of unlicensed views in a single day. It's not surprising that horror dominates this date, with new releases and cult titles driving extraordinary levels of audience activity.

Franchises That Keep Haunting

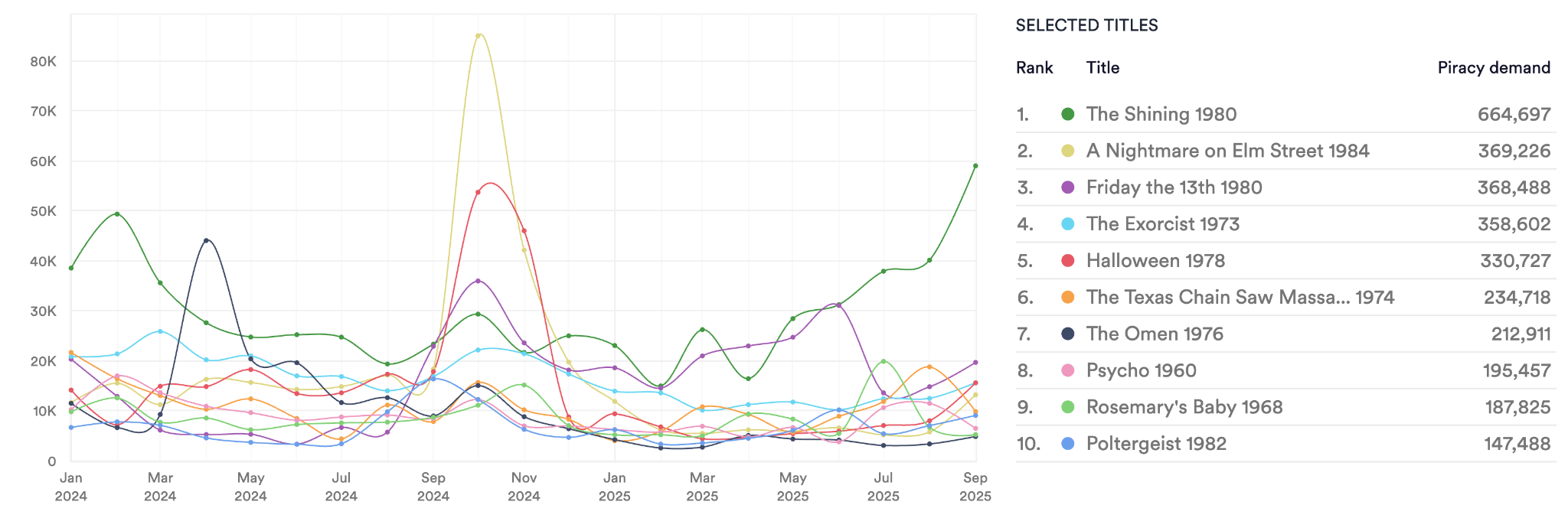

Classic horror has its own seasonal rhythm too. Looking at data from January 2024 onwards, every one of the top ten classic titles shows a sharp increase in demand around Halloween. The pattern is unmistakable: as the nights draw in, audiences return to the genre’s foundations.

The titles driving this annual spike are The Shining (1980), A Nightmare on Elm Street (1984), Friday the 13th (1980), The Exorcist (1973), Halloween (1978), The Texas Chain Saw Massacre (1974), The Omen (1976), Psycho (1960), Rosemary’s Baby (1968) and Poltergeist (1982).

These films have been part of the cultural fabric for decades, and yet their demand still surges at the end of October.

Ten classic Horror movies demand data since Jan 2024

What People Choose to Watch

Not all horror behaves the same way. MUSO’s subgenre heatmap reveals that supernatural horror leads the field, reaching a peak index of 100 in Q3 2025, marking the largest month in demand since MUSO's tracking began in July 2019. Monster, demonic, and slasher films consistently rank close behind, while classic Halloween-themed titles surge in the final quarter of each year.

The pattern is clear: people turn to specific kinds of stories at this time of year. Although patterns are consistent - ghost, demon and monster stories are popular around Halloween, trends change year on year. This year, supernatural stories dominate, whereas last year, monster or serial killer films were the genres of choice. You don't need a crystal ball or a psychic to predict these trends - MUSO’s data can do this for you.

The Franchises That Keep Haunting

Horror is unusually durable all year around. They have long viewing tails, with audiences returning years after release.

The top horror titles by piracy demand since 2019 include:

- Hellboy (2019)

- It Chapter Two (2019)

- Alien: Romulus (2024)

- Godzilla Minus One (2023)

- Sinners (2025)

- Five Nights at Freddy’s (2023)

- The Substance (2024)

- Ready or Not (2019)

- A Quiet Place Part II (2021)

- A Quiet Place: Day One (2024)

Several of these films, like Hellboy and It Chapter Two, continue to attract millions of views more than five years after release. Others, such as Alien: Romulus and The Substance, have surged quickly on the back of recent launches. Horror franchises tend to hold their value longer than most genres, with old and new titles circulating side by side.

How Subgenres Shape Strategy

The subgenre data shows a distinct pattern of demand. Supernatural stories dominate, monster films have strong peaks, and slasher titles maintain steady volume. The Halloween subgenre itself rises sharply every Q4.

This kind of consistency gives rights holders something rare: a predictable viewing window. Releases, campaigns, and catalogue pushes can be timed around this seasonal rhythm rather than simply reacting to it.

The Faces Driving Horror

Audience loyalty also gathers around specific talent. Over the past year, the most in-demand actor among horror audiences was David Howard Thornton, the star of Terrifier 3. He ranks far ahead of the pack, reflecting the power of fan-driven IP. He is followed by Isabela Merced, Vera Farmiga, Naomi Scott and Bill Skarsgård — a mix of genre veterans and emerging stars.

|

Rank |

Actor |

Score |

|

1 |

David Howard Thornton |

100.0 |

|

2 |

Isabela Merced |

92.2 |

|

3 |

Vera Farmiga |

86.6 |

|

4 |

Naomi Scott |

85.5 |

|

5 |

Bill Skarsgård |

82.4 |

This is a reminder that horror audiences aren’t just loyal to franchises. They follow actors across projects. For marketers, it creates opportunities to build campaigns around recognisable faces as well as titles.

Why This Matters

Halloween has become one of the most reliable cultural drivers of global viewing behaviour. Every year, audiences return to the same types of stories and many of the same titles, while new releases slot into an established pattern.

For studios, distributors, and platforms, this creates a clear set of opportunities:

- Time new releases to align with the seasonal spike.

- Use subgenre trends to target marketing with greater precision.

- Build campaigns around talent that horror audiences already follow.

- Use audience demand signals to shape licensing and windowing decisions.

A Season That Speaks for Itself

Horror doesn’t rely on billion-dollar franchises or one-off blockbusters. It thrives on loyalty, habit, and cultural ritual. Every Halloween, that ritual plays out in the data with striking clarity. For rights holders, this isn’t just a surge to observe from the sidelines. It’s a moment to plan for.

For more spooky content, join MUSO and The Coven (Terrifier 1, 2 and 3) for our Webinar looking at the Talent Demand module on the 6th November!