MUSO’s unlicensed audience demand data provides essential insights into viewers' preferences for TV content. The latest audience demand snapshot of the most downloaded TV shows globally reveals a compelling lineup of serials that are making waves in the unlicensed consumption market. Among these are high-profile series like "Loki S2 2023" and "Gen V S1 2023," along with fan-favourites such as "The Last of Us S1 2023" and "Rick and Morty S7 2023."

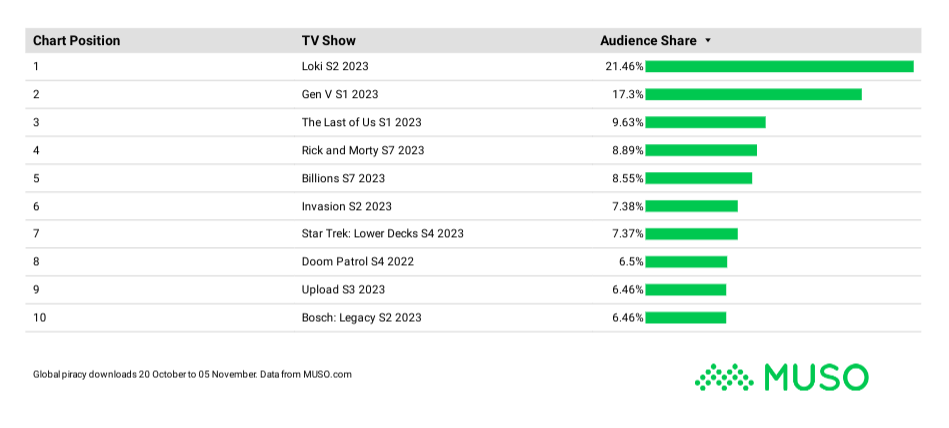

The chart below presents a glimpse into the global TV show audience demand from unlicensed piracy websites for the period ending on the 5th of November 2023.

Key Insights

A Few Top Titles Dominate with a significant long tail

The leading TV shows, "Loki S2" and "Gen VI S1", hold nearly 40% of total global audience share. Such a dominant audience share for the top positions indicates that a small number of shows command a significant proportion of the piracy market's attention.

As we move down the list, there's a noticeable decrease in audience share. Third spot and below command audience shares in the single digits, while the bottom three in the top ten hover under 6.5%. There is also a significant long-tail distribution of titles outside the top ten. While audience shares for these titles might be under 6%, this may still equate to a significant volume of demand in the millions of visits.

Topping the chart is "Loki S2" which has seized a considerable 21.46% of the global audience share. This standout figure not only highlights the show's massive popularity but also brings to light the potential revenue impacts due to unlicensed streaming and downloads.

Not far behind is "Gen V S1" capturing 17.3% of the audience share, a strong start for the new series. This level of unlicensed viewership indicates a robust interest in the show, which could be driven by its connection to the successful "The Boys" universe and the buzz generated by its release and marketing efforts.

Animated comedies and video game adaptations in high demand

"Rick and Morty S7" and "The Last of Us S1" also make significant appearances with 8.89% and 9.63% audience shares respectively, showing that animated comedies and video game adaptations are highly coveted on piracy platforms. The enduring appeal of "Rick and Morty" continues to resonate with audiences seeking unlicensed avenues, perhaps a reflection of its edgy content that aligns with the more rebellious nature of piracy. It is worth mentioning that The Last Of Us, the most pirated TV series of 2023, continues to hold a top three position despite the series ending on legitimate channels in March 2023.

sequels and Franchises Drive repeat unlicensed demand

Interestingly, "Billions S7" maintains a solid audience share of 8.55%, indicating that even established dramas with multiple seasons continue to draw viewers outside of authorised channels. Indeed, 90% of the top ten are continuations of existing stories and part of extensive globally recognised franchises with a deep history and vast back stories. This hints at a consistent unlicensed viewer base that reflects legitimate audiences and is keen to follow the narrative as it unfolds across seasons. This suggests that for some fans, the anticipation to engage with ongoing storylines outweighs the wait for legitimate access.

Sci-Fi and Fantasy Preferences are prevalent

Science fiction and fantasy continue to hold their ground in the unlicensed market. Together with Loki and GenV, "Invasion S2", "Star Trek: Lower Decks S4" and "Doom Patrol S4" claiming their stake at 7.38%, 7.37% and 6.5% audience shares, respectively. The sustained popularity of these genres speaks to the escapism they offer, a trait that might be particularly attractive to audiences navigating the unsanctioned waters of online streaming.

As we round out the top ten, "Upload S3 2023" and "Bosch: Legacy S2 2023" represent the more grounded and reflective narratives, yet they each garner 6.46% of the audience share, underscoring that the appetite for diverse storytelling exists across all viewing platforms, licensed or not.

This data set provides a crucial window into the world of unlicensed TV show consumption, showing us the varied tastes and preferences of viewers who frequent piracy sites. The entertainment industry can utilise such insights to develop more effective strategies to convert these audiences into legitimate content consumers, addressing the drivers that push them towards piracy, such as availability, regional demand and accessibility issues, pricing models, or a desire for immediate gratification. As the sector continues to innovate in content delivery, understanding these audience demand trends will be key to curbing the tide of digital piracy.