Warners Bros. recently announced that throughout 2021 it will release all of its films in theatres and simultaneously on HBO Max. This has caused much controversy and comment across the industry, but with COVID-19 decimating box-office takings globally who can really blame them? Streaming services are their route to profit.

MUSO has been asked to comment on what effect this may have on piracy. In order to answer that question, we have compared windowing piracy data from titles that had a theatrical release vs. those that went straight to VOD services.

Film Piracy: The current landscape.

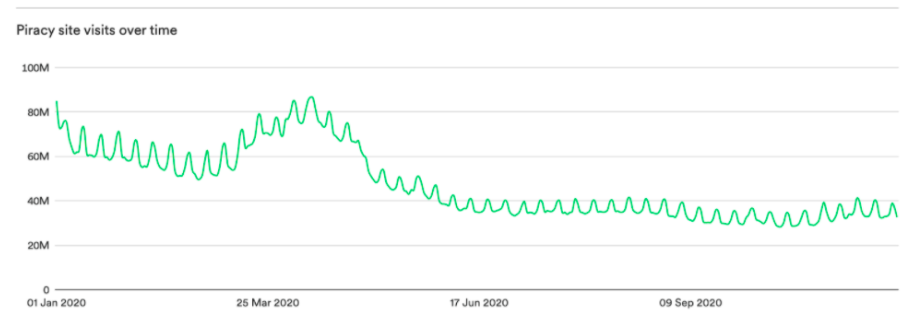

MUSO saw a surge in visits to film piracy sites in March and April during the first lockdown. However, the lack of new blockbuster releases, with titles like James Bond being pushed back into 2021, have resulted in a general decline in film piracy visits over the summer months of 2020.

Film Piracy Visits: Jan - Nov 2020

Data from MUSO.com. Streaming only, excludes torrent data.

Comparing Titles:

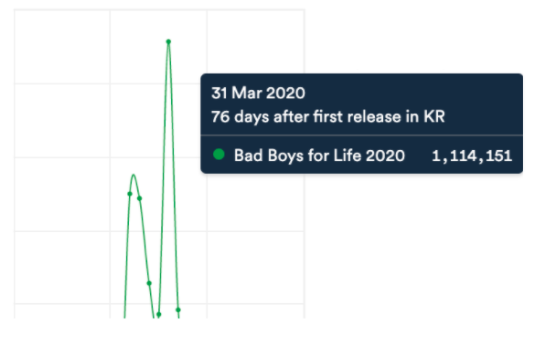

Bad Boys For Life, the sequel to Bad Boys II featuring Will Smith and Martin Lawrence, was released on 17 Jan in cinemas and took $62.5m dollars on its first weekend in the USA. The theatrical window was curtailed in mid-March due to the pandemic and the release was made available via VOD services on March 31, 2020. On the same day, MUSO saw a massive increase in streaming piracy for the title, reaching 1.1m visits to film piracy streaming sites offering that title.

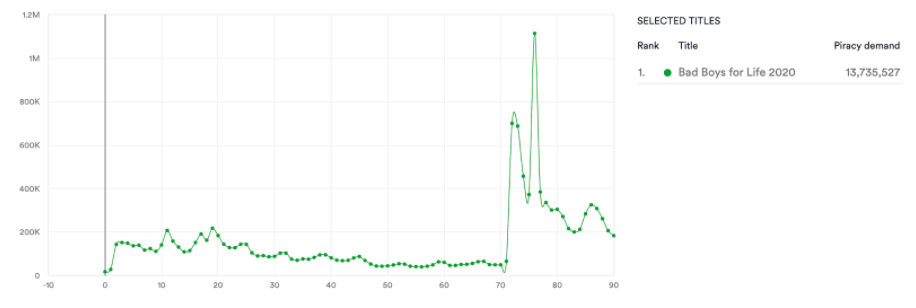

First 90 Days Streaming Piracy: Bad Boys For Life

Data from MUSO.com. Streaming only, excludes torrent data.

March 2020, Initial Release Spike: Bad Boys For Life

Data from MUSO.com. Streaming only, excludes torrent data.

Data from MUSO.com. Streaming only, excludes torrent data.

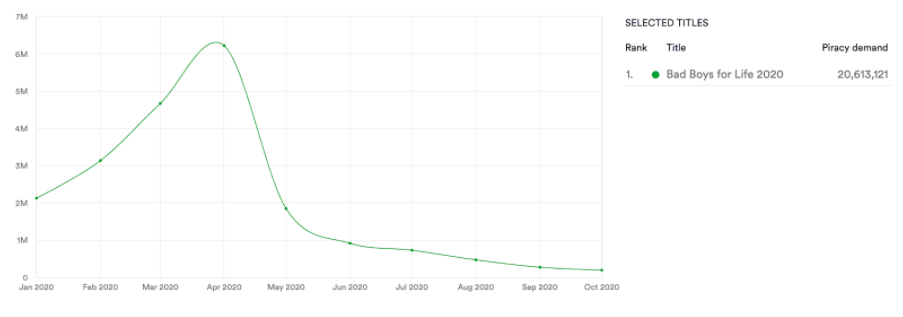

To date MUSO has tracked over 20m visits to streaming piracy sites for this title. Piracy was relatively contained until the digital release in March, when piracy grew exponentially.

The obvious conclusion here is that a longer theatrical window reduces piracy but it’s not quite that simple.

Many potential pirates will have already seen the film in the cinema before the digital high definition (HD) leak is shared, but we see a sharp increase in piracy when a title goes to VOD, driven by people who didn’t see a title in cinemas and didn’t want to experience it via a cam-rip so waited until they can access a pirated HD version.

Jan-Oct 2020 Streaming Piracy: Bad Boys For Life

Data from MUSO.com. Streaming only, excludes torrent data.

Comparing Cam-Rip vs High Definition (HD)

In a previous white-paper, MUSO compared the first 7 days of cam-rip piracy to the first 7 days of HD piracy for visits to streaming sites, to look for a comparative indication of demand during and after the theatrical release window.

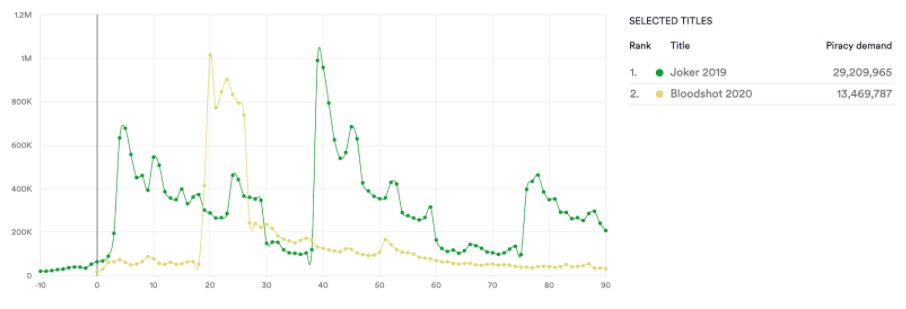

Bloodshot, which only had a theatrical window of a few days, saw an increase of 1607% between the first 7 days of the cam-rip to the first 7 days of HD piracy, whereas Joker - which had a full release window - only saw a 29% increase in streaming visits when the high-quality version leaked, compared to the first 7 days of the cam-rip leak.

Once again, this points to a longer theatrical window reducing piracy. However, if we compare actual demand over the first 90 days of release, Joker had more than double the actual number of visits to streaming piracy sites. It also had three key spikes in demand compared to just the one for Bloodshot, when it first became available on VOD.

Streaming First 90 Days: Joker vs Bloodshot

Data from MUSO.com. Streaming only, excludes torrent data.

The problem with this type of analysis is that it is difficult to compare any two film titles with empirical accuracy as there are so many variables, from the actor or director’s cachet to critical review to competitive landscape, but perhaps the piracy data is pointing to something slightly more obvious.

Word-of-mouth hits drive demand.

Christopher Nolan’s recent comments on Warner’s decision to adapt its release strategy highlighted that these big budget films require big-screen experiences.

“In 2021, they've got some of the top filmmakers in the world, they've got some of the biggest stars in the world who worked for years in some cases on these projects very close to their hearts that are meant to be big-screen experiences. They're meant to be out there for the widest possible audiences…”

The big-blockbuster movie experience along with the red-carpet event generates word-of-mouth buzz, water-cooler moments and a pent-up demand that in turn creates more piracy.

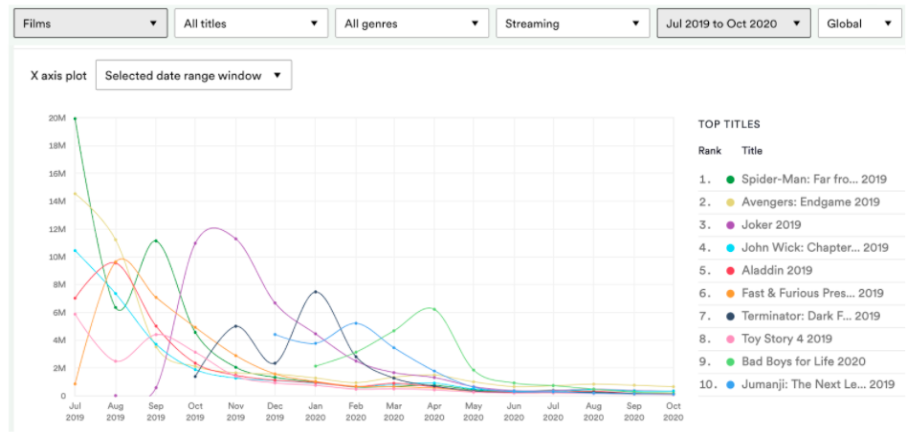

Looking at MUSO’s data from July 2019 to October 2020 we can see that it’s only the 2019 titles that had this theatrical window and built up popular momentum that have even registered within the top 10 most pirated films. Bad Boys For Life is the only title from 2020 included in the top 10.

Top Ten Pirated Films: Jul-Oct 2020

Data from MUSO.com. Streaming only, excludes torrent data.

Christopher Nolan’s own blockbuster Tenet bucked the trend in 2020 of not pushing back during the pandemic and released on August 26th in most territories. Although cinemas have suffered capacity restrictions due to the pandemic and many have been shuttered entirely, Tenet has had little competition and racked up worldwide box-office takings of $360m to date.

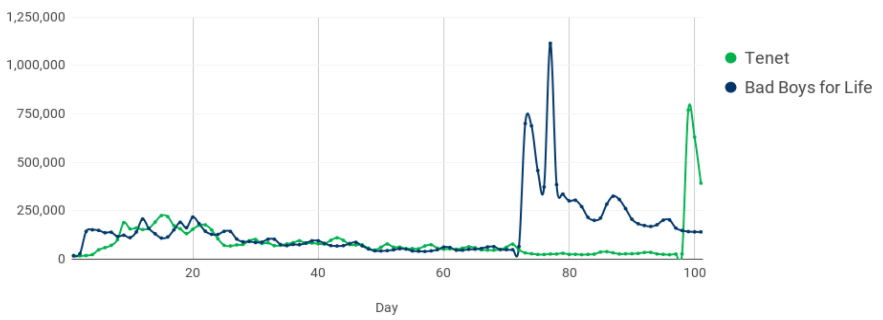

If we compare the piracy data of the first 101 days of Tenet to the first 101 days of Bad Boys For Life ($426m box-office taking to date).

First 101 Days Streaming Piracy: Tenet vs Bad Boys For Life

Data from MUSO.com. Streaming only, excludes torrent data.

Data from MUSO.com. Streaming only, excludes torrent data.

We can see that the piracy demand follows a similar trajectory. MUSO detected the first HD piracy leak for Tenet on Nov 28th 2020 well in advance of its digital release date of Dec 15th.

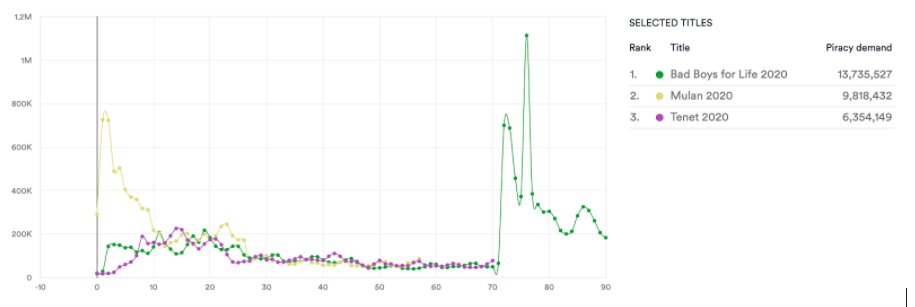

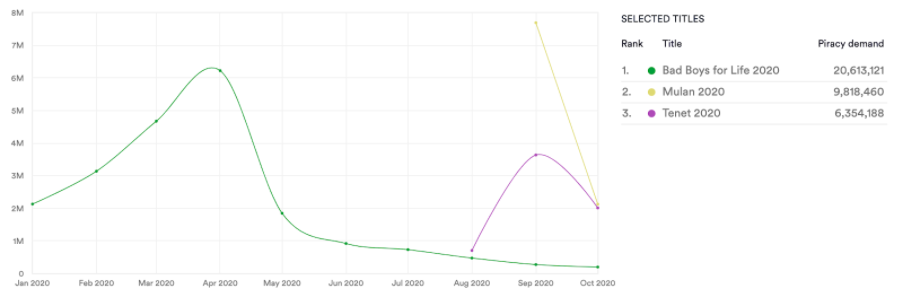

When we compare these two titles with Mulan, which went straight to VOD we see a very different trend in piracy demand.

First 90 Days Streaming Piracy: Tenet vs Bad Boys For Life vs Mulan

Data from MUSO.com. Streaming only, excludes torrent data.

Whilst there is significantly more piracy for Mulan than Tenet, the initial piracy spike happened in the first few days of its digital release and has subsequently declined much in line with the other two titles. Mulan essentially front-loaded its piracy activity.

Streaming Piracy Jan-Oct 2020: Tenet vs Bad Boys For Life vs Mulan

Data from MUSO.com. Streaming only, excludes torrent data.

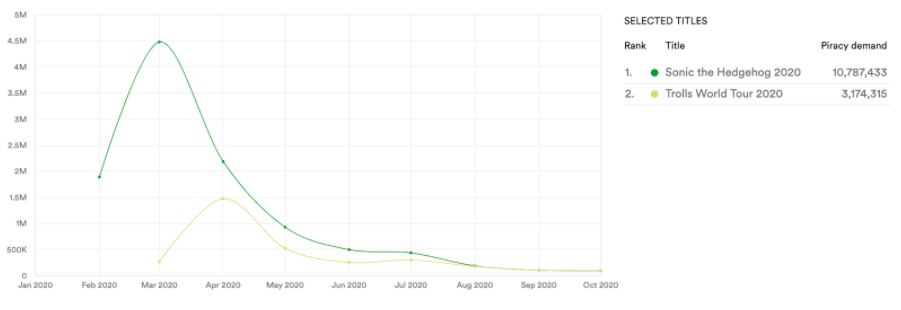

Sonic vs The Trolls

Streaming Piracy Jan-Oct 2020: Sonic the Hedgehog vs Trolls World Tour

Data from MUSO.com. Streaming only, excludes torrent data.

When we compare piracy data for Sonic the Hedgehog and The Trolls World Tour perhaps we get a clearer picture of demand driven by the theatrical window.

Sonic was eventually released on Feb 14th 2020 and had a brief theatrical window until COVID-19 expedited its digital release via VOD sites on March 31st 2020.

Trolls World Tour was released both via VOD and USA cinemas on April 10th with some cinemas in Russia, Singapore and Malaysia having a brief release in March.

Sonic is clearly a far more pirated title, but Trolls World Tour netted more profit for Universal from VOD sales in its first three weeks than the original Trolls movie did in US theatres over five months. Perhaps Universal’s strategy took the heat out of piracy by making the title widely available legally at an affordable price.

Piracy data is a reflection of interest and is seen by its users as a method of delivery, just like Amazon Prime or Netflix. If ‘the message is the medium’ then understanding the nature of the platform of piracy, and the drivers of adoption by the users (ie. cost and availability), are the important questions to ask if we are to understand how to convert them back to licensed and paid VOD users.

Perhaps the question is not whether the theatrical window increases or decreases piracy, but whether the theatrical window increases interest in a film and builds up a word-of-mouth momentum that is then reflected in the long-tail of piracy demand data.

To find out more about MUSO Discover contact:

About MUSO

MUSO is a data company that provides the most complete and trusted view of unlicensed media consumption and global piracy demand. MUSO’s unrivalled dataset measures a vast high intent audience that is not influenced by licensing restriction or platform bias. Whether protecting IP or building winning content strategies, MUSO helps companies make better decisions that drive performance, ROI and value.