During a keynote speech at the 2017 INTA Annual Meeting, Iñigo Mendez de Vigo, Spain’s minister for education, culture, and sport, told the audience that Spain will raise “an anti-piracy generation” as part of its pledge to tackle intellectual property infringement.

Alongside a campaign designed to highlight to children the damage caused by piracy, the minister announced that a special prosecutor’s office will be developed, enhanced by technology and human resources, to continue the fight against unlawful consumption of digital content. From this combative statement, it’s clear that Spain is gearing up its war against piracy.

Spain has long been known as a safe-haven for global piracy, with the US Trade Representative (USTR) issuing a warning in 2013 that their government should be applying measures to restrict and reduce such activity. Since 2012, Spain has made a series of adjustments to local copyright law, each aimed at clamping down on online distribution of copyrighted content and quickly shutting down pirate sites. As a result, there have been effective raids on two of the country’s leading video streaming sites, and Goear, a popular music piracy site, was blocked in 2015. Nonetheless, Spain is still 10th in MUSO’s 2017 Global Country Rank, totaling 4.9 billion visits to such sites.

The music industry had been affected by piracy in Spain. Between 2001 and 2013, the country’s annual recorded music revenues dropped by a shocking 80.2%, from 626.1m Euros to 123.7m Euros. Over a decade, Spain’s recorded music industry slowly spiraled into obsolescence, with unlawful access to online content part of the Spanish cultural mainstream, exacerbated by a lack of strong governmental and legislative framework to combat the increasingly destructive issue.

Read our blog: ANTI-PIRACY REVOLUTION CONTINUES FOR GLOBAL MUSIC AND FILM ARTISTS

Since 2013 the rapid growth of legal streaming (29% of Internet users in Spain use Spotify), has seen the balance redressed somewhat, music piracy is still very much a threat. In 2015, Spain totaled 863 million visits to piracy sites, placing itself as 10th in MUSO’s Global Music Country Rank. Torrent usage was huge in Spain, accounting for over half (52.7%) of the all of the unlawful consumption, and making it one the fourth highest consumer of global public torrents in the world. Despite the Spanish audience overwhelmingly engaging with torrents over any other piracy delivery methods (rippers, download, streaming, private tracker), throughout 2015 Spanish music piracy remained stagnant, increasing by only 2.09% from the first 6 months visits to the last 6 months visits. Despite a strengthening legislative framework and social reinvigoration towards legally streaming, there was clearly still a long way to go.

2016 was no different in terms of audience engagement with piracy. Even though Spain dropped from 10th to 12th in MUSO’s global country by piracy visits, there were still 795m visits. However, Spanish audiences were beginning to diversify their piracy consumption, and while Spaniards still had a high percentage of torrent activity compared with other countries, they were beginning to see a more even share with web streaming, ripping (a rising global threat to the music industry) and download.

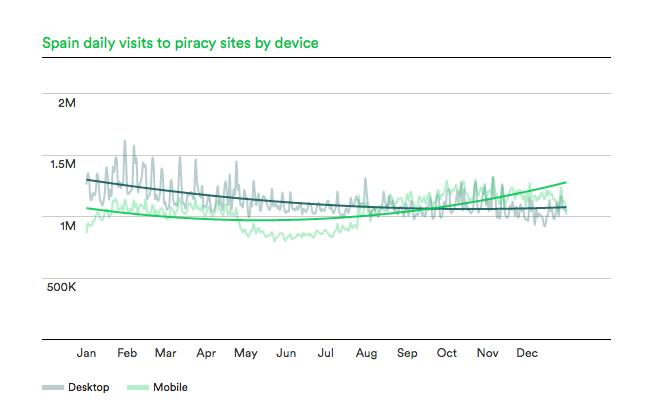

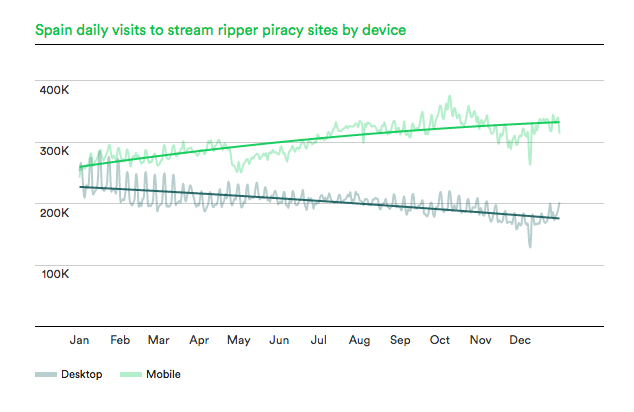

Overall, mobile piracy grew up by 12.54% from the first 6 months to the last 6 months and across the majority of piracy delivery methods – specifically stream rippers. In a previous Magazine piece, MUSO investigated the rising threat of stream rippers, especially mobile stream ripping, which have become a ubiquitous force in music piracy – in 2016, the global trend from the first six months of the last six months for mobile stream ripping grew by 11.22%; and in Spain stream rippers by grew by 4.36% from the first 6 months to the last. Spain’s increasing acceptance of stream rippers as the status quo of music piracy is in line with the trend globally.

Spain is Europe’s leader in smartphone penetration. A report by Fundacion Telefonica, “La Sociedad de la Informacion en España,” found that more than 80% of Internet users in Spain access it through mobile devices, which represented a 4.6% increase over the 2013 figures. Another data point the study illustrates is the growth in the number of users that access the Internet daily – from 18.6 million users in 2013 to 20.6 million in 2014. The growth in mobile connectivity has most likely played a key role in the surge of mobile piracy. The impact of this intense and growing mobile penetration can be illustrated in Spain’s illegal streaming trends, as audiences are rapidly disengaging from desktop streaming (the trend change from the first 6 months to the last 6 months was -24.63%) and leap-frogging over to mobile streaming which saw an increase of 19.88% between the first 6 months to the last 6 months. The same can be said towards stream rippers, which witnessed the trend change from the first 6 months to the last 6 months drop by 11.7% for desktops and rise by 13.84% for mobile. This momentum towards mobile connectivity is unlikely to stop anytime soon, with 4G becoming more widespread, and visits to sites such as youtube-mp3.org, which received over 250K visits daily, are commonplace.

It’s an uphill battle. During 2016, total piracy cost the Spanish economy an estimated 1.8 billion euros in profits which, had the content been paid for, could have led to the creation of 21,697 jobs, 33% increase, and 110,000 more indirect jobs. The music industry lost a whopping 398 million euros. In 2016 the State could have gained an additional 576 million Euros has it not been for illegal content, an accumulated amount of 2.772 billion euros from 2012. These are damning numbers for the Spanish content economy.

However with the diversification of piracy consumption, alongside an increasing trend towards mobile piracy, content owners are going to have to do more to engage with their audiences to provide them with legal content. Data from MUSO’s Retune platform indicates music audiences are willing to engage with, on average, up to 10% of the piracy market, and in so-doing reconnect to licensed platforms with content available. Retune’s remarketing solution is also building lasting relationships with audiences and connecting content owners with audiences that may have been lost to piracy. There is no doubt that the Spanish music industry is going to have re-invent itself in order to avoid further losses and reconnect with a new generation of music fans.

To find out more about MUSO’s suite of piracy solutions, please visit Products.