MUSO examines the Australian Piracy Problem and how the market is adapting to quench the public's appetite for legal content.

In 2015, Australia became the king of Game of Thrones copyright infringement. With a country of just over 22 million people, it snagged the number one spot away from the USA and the UK with 11.6% of the total download rate. These are unsurprising numbers to an industry well aware of Australia’s increasing dominance of the piracy tables. However audience download statistics represent only a small part of the complex failure to date in better capturing the hearts and minds of an often-frustrated audience.

Throughout 2015 the Australian Government has been lobbied hard by its own MPs to take a balanced approach against online piracy, resulting in a more hardline approach to an amended copyright infringement legislation. Early this August the Federal Court placed new limitations on Voltage Pictures, rights-owner of the Oscar winning film ‘Dallas Buyers Club’, from personally identifying over 4,700 subscribers via their ISPs who allegedly downloaded copies of the movie from torrent sites. The court ruling was primarily motivated at limiting ‘speculative invoicing’, a technique used to leverage a cash settlement for potential IP infringement on peer-to-peer (P2P) networks. It’s a practice dimly viewed inside the industry, marketed strongly by the select few companies providing the service as an easy payday. Ever-hopeful rights holders continue to assign their rights in the hope of potentially unlocking some extra cash.

Read our blog: MEASURING ROI IN CONTENT PROTECTION: HOW VALUABLE IS ANTI-PIRACY?

The Voltage case is game-changing. The ruling means enforcement strategies are not limited to demanding damages from downloaders the equivalent to the cost of the copy of the film and an appropriately proportioned fee to recover its legal costs. The crux of this court order centred on Australia’s reaction to piracy, concluding on a preference to treat pirates less as criminals and more as individuals committing misdemeanours.

This approach is similar to that in the UK. Adam Morallee is a partner at IP specialist firm Brandsmiths and Head of MUSO’s Legal Products, and he explains;

“The Civil courts in jurisdictions like the UK and Australia don’t like punishing people – the remedy for rights owners is to be compensated for the actual loss they have suffered. The concept of damages as a deterrent or as punishment is one that is much more commonly used by Judges in the USA. In the UK, civil suits can be brought for ‘flagrancy’ damages, but it isn’t commonplace. Legal costs are recoverable though, and rights owners should not be going out of pocket at all.”

Another groundbreaking legal order; the Australian courts passed the Copyright Amendment (Online Infringement) Bill 2015, permitting the blocking of websites proven to have infringing content. Major international non-compliant piracy hubs, like The Pirate Bay and Torrentz.Eu, saw a combined total of 5.2m visits from Australian audiences in October are likely to be hit first. Despite receiving some backlash from some members of Parliament and the public, the CAOI bill has fared well amongst copyright academics and media executives. Simon Bush, head of the Australian Home Entertainment Distributors Associations, called this a “watershed moment,” saying, “It’s a fantastic day and a really positive sign for the creative content industry, who can invest more as a result.”

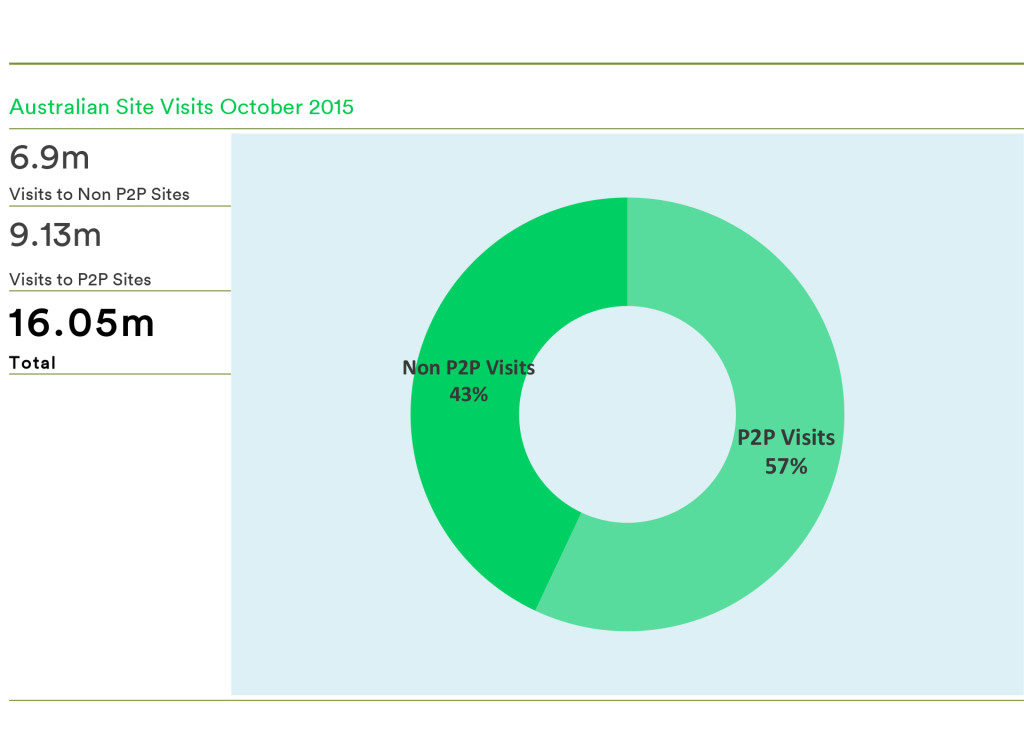

Analysing the most popular 18 piracy domains by Australian audience size for October, MUSO’s analysis of the Australian piracy market reveals over 16m visits, highlighting only a small ongoing preference by audiences towards P2P/Torrent downloads over the more convenient direct download or streaming sources.

As a blocking strategy already in place in countries such as the UK, the Copyright Amendment Bill has the potential to become an important line of defence by rights owners when employed as a coordinated strategy. However, this starts with a closer understanding of audience size and behaviour. Products like MUSO’s Market Analytics treats piracy audiences as an opportunity for engagement, while our Market Disruption and Legal Products ensures long-term change in preventing audiences from discovering the most high-profile piracy destinations, therefore making consumption of legal content easier and more likely.

Against the backdrop of court battles and legal showdowns, the reason as to why such large numbers of Australians choose to pirate instead of using legal avenues has hardly been discussed. This July, the Communications Minister and current Prime Minister of Australia, Malcolm Turnball released research showing that a quarter of Australian Internet users pirate content. A survey done by CHOICE points out two key factors: the high cost of content along with the time delays of international shows premiering on Australian networks. Foxtel holds a monopoly in direct broadcast satellite television, scooping in premieres from HBO such as Game of Thrones. Their exclusivity deal has locked out Australians from accessing the show a-la-carte via iTunes or HBO-Go. With no individual on demand packages (starting package is a £33 monthly annual subscription) and no appetite to date for enabling individual episodes via VOD, Australian audiences who are ultimately looking for content to be cheaper and faster are finding themselves out of luck.

Turnbull’s research survey drew light on the fact that 39% of pirate audiences would opt for the legal option if content were cheaper, 38% would stop if it was more available, and 36% would stop if it had the same release date as other countries. The market is telling us a large majority of Australians who are waiting for that next HBO blockbuster series on P2P would, in theory, already be Foxtel customers if the market supported their needs. Netflix has already been shaking the piracy tree since its local launch in March 2015. Australians got a good deal with Netflix; thanks to the region’s high levels of piracy the video-on demand provider lowered their subscription price in order to meet the appetite of a market demonstrating huge demand. Even though official statistics are unavailable (due to Netflix’s strict private data policy for its audience demand metrics,) the company’s influence within the Australian piracy market is an obvious path in the right direction. An estimated 737,000 Australian households already have Netflix, making it the most popular digital streaming platform in Australia.

Yet stormy waters could be on the horizon as the Australian digital content industry attempts to realign itself. Since the introduction of Netflix, there have already been causalities; EzyFlix, an online version of Blockbuster closed in August. The bigger battle is still to come as Netflix and Foxtel go head-to-head for the majority share of the VOD market. The lines of this battlefield are still being drawn, with Foxtel firing early shots.

Better legal streaming options have already made audiences realise there shouldn’t be an excuse not to support the artist or industry. Maturing statistics for the Norwegian and Swedish streaming markets are hinting towards a curbed piracy rate in music, TV and film.

Legally it’s clear Australia isn’t going to be bullied into speculative invoicing, with its revised legislative approach regarding the need to reduce piracy. The timing now seems right for its content industry to develop the right strategies towards digital content distribution and to provide a compelling, accessible solution for an audience demanding a better experience online. Anti-piracy measures are being widely adopted and access to piracy domains can be curbed through technological innovation and supportive legislation. Third party anti-piracy solutions, such as MUSO’s Market Disruption and Legal Services platform, directly attack the P2P, torrent and cyberlockers. These provide long-term benefits to the local market along with the added support of a robust legal framework.

But Australian content owners need to embrace demand. With the relevant insight and understanding of the Australian market, what’s needed now is a market favourable to the expansion of VOD platforms to further connect with a huge, willing audience.

To find out more about MUSO’s suite of piracy solutions, please visit Products.